Yape (payment)

| Yape | |

|---|---|

| |

| Developer(s) | Banco de Crédito del Perú[1] |

| Stable release | 3.46.2 (Android) 3.46.0 (iOS) |

| Platform | Android, iOS |

| Predecessor | Soli (Bolivia) |

| Size | Android: 77 MB iOS:326.8 MB |

| Available in | Spanish |

| Type | Payment service Payment network |

| License | Yape © 2025 |

| Website | yape.com.pe |

| Company | |

| Founded | September 5, 2016 in Lima, Peru |

| Headquarters | Jr. Centenario 156, La Molina 15026 |

Areas served | |

| Products | YapePOS |

Yape (pronounced [ˈʝape]) is a super-app digital wallet and mobile payment application leading in Peru,[2] developed by the Banco de Crédito del Perú (BCP) in 2016, designed to simplify financial transactions for individuals and businesses.[3][4] As of 2025, it serves over 20 million users; enabling instant, commission-free peer-to-peer transfers, bill payments, and purchases using a smartphone via a phone number or QR code, without requiring a traditional bank account, thus promoting financial inclusion for the unbanked population.[5][6] The app has evolved into a comprehensive financial platform, offering services such as microcredits, international remittances, and e-commerce purchases through Yape shop, with a 93% transaction approval rate and integration with global payment networks like TerraPay and EBANX to facilitate cross-border transactions.[7][8][9] Its user-friendly interface and widespread acceptance by over 2 million businesses have made it a cornerstone of Peru's digital economy, reducing cash dependency and fostering seamless, secure financial interactions.

Origins

Traces its origins back in 2016 when it was launched by the Banco de Crédito del Perú as an innovative solution to facilitate mobile payments. Conceived within BCP's headquarters, Yape was initially designed to enable quick and simple money transfers among young users without the need to use an ATM or a debit card, leveraging the growing use of smartphones in Peru.[5] The application allowed users to send and receive money using only a mobile phone number or QR code, eliminating the need for cash or traditional banking infrastructure.[10]This focus on accessibility and convenience, positioned Yape as a transformative tool in a country where cash transactions were predominant, with over 90% of payments for goods and services made in cash as of 2022.[11]

History

In its early years, Yape targeted BCP account holders, particularly young professionals and university students,[5] but faced challenges in adoption due to low banking penetration rates among its initial target demographic. By 2017, the platform expanded to include users from other banks, significantly broadening its reach. The application's growth was further accelerated by the COVID-19 pandemic, which heightened the demand for contactless payment solutions.[12] During this period, Yape became a critical tool for millions of Peruvians, smoothing safe and efficient transactions for everyday purchases, bill payments, and peer-to-peer transfers. By early 2020, Yape had 3.5 million users, with an additional 1.5 million joining during the pandemic, reflecting its role as a vital financial tool.[6]

The platform's evolution included the introduction of new features to enhance its utility and inclusivity. In 2020, Yape launched the Yape Card, a virtual card that allowed users to register with only a national identity document (DNI), removing the requirement of a bank account.[1] This development significantly advanced financial inclusion, enabling unbanked individuals to participate in the digital economy. By 2023, Yape had grown to over 12 million users, processing 10 million transactions daily, and expanded its services to include microcredits, bill payments, and mobile recharges.[13]

Despite its achievements, Yape faced significant challenges. The application nearly failed on three occasions due to initial resistance from users accustomed to cash, internal resource allocation issues within BCP, and difficulties in promoting the app through traditional banking channels. Strategic adaptations, such as focusing on small merchants and introducing QR code payments for businesses, helped overcome these hurdles.[14] By 2024, Yape had 14 million users, with approximately one in two Peruvians using the app, and it introduced features like international remittances and currency exchange. The platform's partnership with Brazil's EBANX in 2025 further expanded its capabilities for cross-border payments.

Its growth reflects its ability to adapt to Peru's evolving financial landscape. By 2025, it had solidified its position as the leading digital wallet in Peru, with over 17 million users and more than 2 million businesses accepting Yape payments. The platform's integration with other digital wallets, such as Plin, and its collaboration with the Banco Central de Reserva del Perú to develop a real-time payment system similar to India's UPI underscore its commitment to innovation and interoperability.[11]

Name origin

In Peruvian slang, yapa is a widely used term originating from the Quechua word ñapa, meaning "to add" or "to increase."[15] In terms of food establishment, it denotes a small petition for a bonus during consumption at food stalls, such as an extra portion of food at markets or food stands.[16] This term is deeply ingrained in everyday interactions, where it symbolizes goodwill and fosters customer loyalty.[17]

However, an alternative hypothesis suggests that Yape may also be linked to the Peruvian colloquial expression Ya, pe (a shortened form of ya, pues), which has a rough translation to come on, okay then or even alright in English, depending the context. This phrase is commonly used in informal speech to express agreement, urgency, or encouragement. According to Rufino Arribas, an innovation, strategy, risk, and finance specialist and one of the main Yape managers, was his own invention and was chosen due the reason to be catchy and memorable.[18][2]

The super-app changed the way payments, transfers, and mobile top-ups are made, to the point that the word "yapear" became a generic verb to refer to digital transactions and part of Peruvian Spanish dialect.[19]

Technology evolution

With time, Yape began to improve its interface and transfer methods. When Yape launched, it was mandatory to link it to a bank account, whether with BCP or another affiliated bank or savings bank. Subsequently, in 2019, announced its independence from BCP and the following year enabled the option of opening a Yape account without having to link it to any bank account.[20]

Originally it began as a person-to-person payment app, but later expanded its horizons to target small and micro businesses as a new audience, which could benefit by facilitating the exchange of value without the need for cash.[21] It also added a QR code scanning function, which, through activations and commercial guidelines, informed businesses and customers how to use the feature, promoting it as a new way to pay. One of its most well-known partnerships was with D'Onofrio ice cream makers, who adopted this method, further boosting its use.[20] This action motivated other independent businesses to use the digital wallet in kiosks, market stalls, service businesses, taxi drivers, etc., helping many startups take off.[18] Peru has one of the highest informality rates in Latin America. This, in turn, is related to low banking access rates and, therefore, fewer people able to access credit because banks cannot track their transactions. By solving the problem of visibility into businesses transactions of all sizes, Yape added information to banks' databases so they could offer them tailored loans. Yape's current challenge is to expand its use in provinces where banking access is even lower, as well as digital divide can also work against it. To achieve this, building partnerships with local entities and businesses is key to achieving significant uptake while ensuring benefits for the public.[22]

Notable improvements

In 2019, it introduced new financial features such as utility payments, personal payments via QR code or telephone number,[23] the ability to become a user without a BCP account, savings products, and immediate small-money loans.[22]

Approximately in 2023, minors were allowed to have accounts so they can make payments on their own. All that's required is prior registration with an ID in the app, a joint account, and an alternate email address.[24]

As of 2025, Yape is considering including salary-type payments through digital wallets, so that companies can pay their employees more easily.[25] The withdrawal limit has also been extended to up to S/ 3,500.[26]

Interoperability

Yape's adoption of interoperability with other national digital wallets in Peru, including Plin, IzipayYa (formerly Tunki), Bim, and others, represents a pivotal advancement in the country's digital payment ecosystem. In October 2022, the Central Reserve Bank of Peru (BCRP) mandated interoperability among all digital wallets, culminating in a two-phase implementation.[27] On phase one in April 2023, seamless transactions between Yape and Plin were enabled, facilitated by Visa, allowing users to transfer money instantly using mobile numbers or QR codes across these platforms.[28] By July 2023, the second phase extended interoperability to all Peruvian digital wallets, ensuring that over 14 million users could transact freely across platforms like Yape, Plin and among others, regardless of the financial institution or wallet provider. This initiative, supported by the Peruvian Clearing House and global partners like Mastercard and Visa Inc., resulted in over 1.6 million daily interoperable transactions, significantly enhancing financial inclusion and user convenience.[29] The BCRP's regulation, outlined in Circular No. 0024-2022-BCRP, mandated that entities submit interoperability schedules by October 2022, with full compliance by March 2023, fostering a cohesive digital payment network. This connectivity has driven a surge in digital transactions, with Yape alone handling over 2 million interoperable payments daily, reinforcing Peru's transition from a cash-based to a digital economy and supporting the financial inclusion of unbanked populations.[30]

Security

Since its release in 2016, robust security measures were implemented to ensure the safety of its transactions, evolving alongside its growing user base and transaction volume. Initially, was relied on basic encryption protocols and user authentication via phone numbers or QR codes to secure peer-to-peer transfers. By 2020, as the platform expanded to include non-BCP users and processed over 10 million daily transactions, Yape introduced multi-factor authentication (MFA), requiring national ID verification and biometric options such as fingerprint or facial recognition for enhanced user validation.[31][32] The adoption of Microsoft Azure's cloud infrastructure further strengthened data protection, leveraging advanced encryption standards to safeguard user information and transactions, aligning with BCP's commitment to a secure digital ecosystem.[13] Recent advancements have solidified it's position as a secure digital wallet, particularly with its 2024 partnership with TerraPay for international remittances. This collaboration integrated real-time fraud monitoring and compliance with global regulatory standards, ensuring secure cross-border transactions. Yape's reported 93% transaction approval rate in 2024 reflects its effective anti-fraud measures, supported by BCP's backing and continuous developer training to address emerging cyber threats.[33]

Service diversity

Online shop

On late October 2023, the platform decided to launch its own virtual store, allowing users to purchase items such as technology, household appliances, groceries, and furniture through the app and have them delivered directly to their homes.[34][35]

Services variety

Yape introduced the option to purchase food at discounts in restaurants, supermarkets, convenience stores, and fast-food outlets. This was achieved through strategic alliances with various companies and suppliers, with the goal of make access easier to the public.[37] The initiative also sought to increase the number of partner businesses in Lima and regions such as Trujillo and Arequipa.[38]

Additionally, bus tickets,[39] car insurance, and gas cylinder delivery have been added to the platform's full functionality.[40][41]

The app also allowed users to purchase tickets for events and soccer matches, as well as gift cards for online games, utility bills, and cellphone top-ups.[34] This features which were added much before, along the online shop, made the platform more variated, as well as the increased number of users seeking to purchase something in particular without having to leave the app.[42]

Microcredits

In 2022, when user clients reached to 10 million, microcredits and money loans service were released.[43] Users can obtain the loan in a matter of seconds from the app and can choose specific repayment terms. Those with a bank account were the main benefited.[44]

Remittances income

The integration of international remittance services, launched in 2024 through a partnership with TerraPay,[33] has significantly improved its functionality, allowing users to instantly receive funds from abroad without visiting physical bank branches.[45]

Yape's system maintains partnerships with seven agencies and remittance companies, through which international transfers can be made online, greatly simplifying the process. Two of these entities are the American remittance services Ria Money Transfer and Remitly.[46]

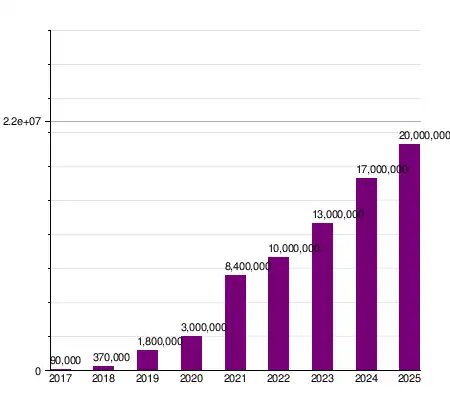

| Yape user Growth per year |

|

| The platform managed to boost their user increase with service diversification. |

In addition, the platform began to offer the possibility of exchanging dollars within the same platform efficiently.[46]

User growth

The app has demonstrated a remarkable user growth since its launch in 2016, reaching people beyond the country's borders on present day.

Between 2017 and 2019, managed accomplishes more than 370,000 users,[20] In 2019, the number of clients were between 1.5 and 2 million.[22][47] By 2020, surpassed more than 4 million[48] but was in 2021, when the platform exceeded the 8 million by leaps and bounds.[49]

During 2022, reached successfully the 10 million users,[50] while in 2023 achieved 10 million clients.[51] On 2024, reached more than 16.5 million clients,[52] while in Bolivia went 1 million of consumers, aspiring to reach more than 2.5 million.[53] [54]

By 2025, Yape has a total of 20 million users in both countries.[55][56] In Bolivia reached one extra million users.[57]

Controversies

Since 2016, the platform has faced several controversies related to its functionality, particularly concerning their unintentional ways of verification and process and specially, misuse of the app.

App misuse

One significant controversy involves accidental payments to unintended recipients, often due to users mistyping phone numbers or scanning the wrong QR codes. The app's design, which relies on phone numbers or QR codes for instant transfers, has led to errors, particularly in busy environments where users may inadvertently select the wrong contact or scan an erroneous one.[58] People and finance entities recommend directly contact the person or establishment that received the erroneous payment and request a refund of the amount sent. However, this does not guarantee that the amount will be recovered, especially if it's not a huge sum.[59]

Another point of contention is the app's practice of displaying the full names of both the payer and payee during transactions, raising privacy concerns among users. Many have expressed discomfort with this transparency, particularly in peer-to-peer transactions involving strangers or merchants, as it exposes personal information unnecessarily.[60] The full name is omitted if the payment was done via telephone number, which is displayed partially censored because Yape does not allow meet another person for privacy.[61]

This feature, intended to confirm recipient identity, has been criticized for lacking user control over privacy settings, especially in a context where digital fraud and social engineering are growing risks. While Yape employs encryption and multi-factor authentication to secure transactions, the full-name display has been a persistent source of unease, as it could potentially be exploited in phishing or impersonation scams.[62]

SUNAT fiscal revenue audit

The Superintendencia Nacional de Aduanas y de Administración Tributaria (SUNAT) has intensified its fiscal oversight of small businesses utilizing Yape for transactions, targeting those with annual revenues exceeding 45,000 PEN to ensure compliance with tax obligations.[63] This initiative, effective from mid-2025, leverages the traceability of digital transactions to cross-reference with declared incomes, aiming to curb informal commerce. However, the measure has sparked significant concern among small-scale entrepreneurs, who fear disproportionate scrutiny and potential account seizures, perceiving it as a burden on modest operations.[64] Critics argue that without adequate simplification and support, such rigorous enforcement may deter digital adoption and drive businesses back to cash transactions, undermining financial inclusion efforts.[65]

Criminal abuse

The app was on serious dispute due to its use in criminal activities, such a scams, frauds, or even cyber thefts.

Criminals have exploited the platform by generating fake payment screenshots or using malicious apks which had a similar interface to simulate legitimate transactions.[66] These fraudulent apps allowed users to create convincing but false bank transfer receipts, deceiving vendors —especially in small-scale markets— who release goods or services without verifying actual payment receipt.[67] Such scams have eroded trust in digital transactions, with victims often discovering the fraud only after checking their bank accounts, as highlighted by reports of fake banking apps mimicking legitimate platforms. In response, Yape introduced a critical security update back in April 2025, implementing a three-digit security code system.[68] This code appears in both the sender's payment confirmation and the recipient's notification, enabling vendors to verify transaction authenticity instantly, rendering older fake screenshot designs obsolete.[69][70]

Another prevalent issue involves fake QR codes displayed at small businesses, designed to install malware or facilitate unauthorized bank account access. These malicious QRs, when scanned, can redirect users to phishing sites or install trojans, which exploit Android devices to steal financial data or remotely control devices for fraudulent transactions.[71] Such schemes have led to significant financial losses, with some cases resulting in complete bank account depletion. To counter these threats, the platform implemented robust security measures, including the introduction of the 1820 speed-dial number to allow users to quickly block their accounts in case of a stolen or lost phone, preventing unauthorized access.[72] Additionally, Yape offers optional insurance to protect users' funds against fraud, providing reimbursement for losses due to unauthorized transactions.[73][74]

Direct robbery usage

A particularly alarming controversy involves innocent civilians, inadvertently caught in criminal investigations after sharing their QR codes.[75] In some instances, individuals have shared their codes with seemingly trustworthy parties, only to receive funds from illicit activities, such as robberies, extortions or bank account emptying schemes. These unsuspecting users have faced arrests, accused of being accomplices, as their accounts contained recently transferred funds linked to crimes.[76][77] Local reports in Lima and other zones of the country also document violent cases, such as thieves assaulting independent market vendors and forcing them to deposit money into the perpetrator's Yape or Plin accounts, exploiting the apps' instant transfer capabilities.[78][79]

Sudden platform crashes

After the decade of 2010s, Yape experienced many nationwide service disruptions on recent years. Notable outages occurred on June and July 2024[80][81] and February and May 2025,[82] with additional incidents reported on May,[83] and an unspecified date during a long holiday period in 2025.[84] These disruptions typically prevented users from accessing the app, displaying error messages.

The outages, often coinciding with peak financial activity periods like mid-month paydays or holidays, affected both Yape and BCP's mobile banking platform, exacerbating user inconvenience.[85] BCP consistently acknowledged these issues via social media, citing technical “intermittencies” and assuring users that teams were working to restore services, though specific causes or resolution timelines were rarely disclosed. While services were typically restored within hours, with other cases; outages were resolved the next day.[86]

Availability

After being a resounding success in the whole country, the platform decided to expand to other territories.

Supported countries

In August 2023, Yape initiated its international expansion by entering Bolivia, replacing the existing Soli Pagos platform, which had 800,000 users.[87] The transition leveraged Yape's proven model of no-commission transactions and registration without requiring a bank account, resonating with Bolivia's largely population. The platform's success led to its expansion into Bolivia in 2023, where it gained one million users within its first month.[1] By early 2024, Yape had reached 1 million business in Bolivia,[88] driven by its simplicity and cultural engagement, such as sponsoring major festivals like the Carnaval de Oruro and Santa Cruz, which connected with over 900,000 attendees.[89]

By the first quarter of 2025, the app's user base in Bolivia surged to over 3 million, with 1.35 million affiliated small businesses, outpacing its initial growth in Peru,[90][91] where it took two years to reach 2 million users. The platform's focus on QR code transactions, which became the preferred payment method, positioned Yape as Bolivia's leading digital wallet, surpassing competitors in transaction volume.[92]

Future of the platform

In addition to its current features, Yape plans to add new functions by 2025.[93] Yape's business model, centered on the war on cash and subsequent monetization, is expected to be replicated in other parts of Latin America, such as Ecuador, Colombia and Central America, where cash use remains relevant.[94][95]

See also

- Plin

References

- ^ a b c "Yape: Building the first SuperApp in Peru". Rebill. May 21, 2024.

- ^ a b Gines, Katty (September 21, 2023). "El éxito de Yape: equipo peruano tocaba puertas al inicio y ahora cuentan con 13 millones de usuarios". trome.pe (in Spanish).

- ^ "¿Qué es Yape?". La Razón (in Spanish). October 28, 2023.

- ^ "¿Dónde y cuándo fue creado Yape?". TN Tendencia (in Spanish).

- ^ a b c F., Jose (30 August 2021). "What is YAPE and how does it work?".

- ^ a b Arenas, Vanessa (2 October 2020). "Andrea Stiglich, Yape: el foco de bancarizar se hizo más evidente con la pandemia" (in Spanish).

- ^ Gloria, Mathias (October 31, 2024). "Peru's Yape and TerraPay to accelerate digital remittances".

- ^ "Yape Peru's Supper App and TerraPay join forces to accelerate digital inclusion". PR Newswire. October 29, 2024.

- ^ "EBANX Offers First Direct Integration for Cross-Border Merchants with Peruvian Wallet Yape". FFNews. 10 July 2025.

- ^ "Yape: Peru's Mobile Payment Game Changer". Apec2016. March 11, 2024.

- ^ a b Gonzalez Bell, José (June 28, 2024). "¿Qué es UPI?: Perú busca implementar un sistema de pagos inmediatos" (in Spanish).

- ^ "La Historia de Yape". UTP (in Spanish). May 17, 2024.

- ^ a b "Yape: la revolución financiera digital en Perú". News Center Microsoft Latinoamérica (in Spanish). March 26, 2024.

- ^ "Yape fracasó la primera vez que se lanzó: la historia de la billetera digital más exitosa de Perú". La República (in Spanish). November 11, 2024.

- ^ "What does ñapa mean?". WordSense.

- ^ "Yapa (en Perú)" (in Spanish).

- ^ "Exploring the Popular Peruvian Expression: 'Yapa'". apec2016. January 15, 2025.

- ^ a b Naquiche, Gabriel (September 28, 2023). "Yape: Historia de la billetera más famosa del País". Infomercado (in Spanish).

- ^ "Yape: ¿Cómo ha revolucionado la aplicación el ecosistema fintech en el Perú?". PerúRetail (in Spanish). March 21, 2024.

- ^ a b c Rodriguez Espino, Guillermo (December 6, 2021). "Yape, Un Antes y un Después". Linkedin (in Spanish).

- ^ Cardozo, Priscilla (June 13, 2023). "Yape: «El gran reto es continuar con la adopción de productos y servicios digitales que vayan más allá de los pagos»". E.Banking News (in Spanish).

- ^ a b c "Yape anuncia nuevas funcionalidades". Agenda Tecnológica (in Spanish). September 17, 2019.

- ^ "YAPE: Transformando vidas y economías a través de la revolución digital". Business Empresarial (in Spanish). November 15, 2023.

- ^ Flores Rodríguez, Daniel (December 21, 2023). "Yape revoluciona: ahora también para los más pequeños y con mayores beneficios". Emprender.pe (in Spanish).

- ^ Pereyra Portugal, Pablo (June 11, 2025). "Sueldos a través de billeteras digitales: una vía hacia un ecosistema de pagos moderno". Infobae (in Spanish).

- ^ "Yape presenta novedades en pagos digitales y permite retiros hasta S/ 3,500". C.E.D. (in Spanish). June 21, 2025.

- ^ "El dia que Yape y Plin se unieron". Zidrave (in Spanish). December 9, 2024.

- ^ Meneses, Valentina (October 15, 2024). "Peru: 2024 analysis of payments and ecommerce trends". PCMI.

- ^ "Usuarios podrán hacer transferencias entre Yape y Plin: ¿se cobrará comisión?". Gestion.pe (in Spanish). October 7, 2022.

- ^ "Yape y Plin deberán operar entre ellas: BCRP publica reglamento de interoperabilidad". La República (in Spanish). October 7, 2022.

- ^ "Yape revoluciona sus transferencias con un cambio sorprendente". Wapa (in Spanish). November 30, 2024.

- ^ "huella digital o identificación facial: ¿Cómo funciona?". Peru-Retail (in Spanish). October 3, 2024.

- ^ a b "Yape Peru's Supper App and TerraPay Join Forces to Accelerate Digital Inclusion". FFNews. October 29, 2024.

- ^ a b "Yape va más allá de los servicios de billetera y lanza su tienda virtual". Forbes Peru (in Spanish). October 30, 2023.

- ^ "Yape lanza oficialmente su tienda virtual". Peru Retail (in Spanish). October 31, 2023.

- ^ García Briceño, Bethania (July 4, 2025). "Transporte sin sencillo: Yape y Plin transforman los pagos en Perú". EcommerceNews (in Spanish).

- ^ "Ahora los yaperos pueden acceder a más de 2 mil promociones a través de Yape". MicroFinanzas (in Spanish). January 1, 2025.

- ^ "Quantica24". Quantica24 (in Spanish). February 4, 2025.

- ^ "Yape lanza nueva funcionalidad para comprar pasajes de bus a nivel nacional". Peru Retail (in Spanish). September 26, 2024.

- ^ Montesinos Nolasco, Edwin (January 17, 2024). "Yape ahora permite pedir y pagar balón de gas". Infobae (in Spanish).

- ^ Bethania, García Briceño (January 19, 2024). "Yape lanza su nueva operación "Yape Gas"". EcommerceNews (in Spanish).

- ^ "Yape Lanza Yape Tienda y espera posicionarse entre las 5 principales Tiendas Online del País". MicroFinanzas (in Spanish). October 30, 2023.

- ^ "Microcréditos en Yape: Qué son, cuáles son los requisitos y cómo solicitarlos por la app". Gestion.pe (in Spanish). September 29, 2022.

- ^ Acevedo, Jordy (August 1, 2022). "cómo funciona en tu móvil para solicitar préstamos". infoMercado (in Spanish).

- ^ "YAPE: ¿Cómo recibir o enviar remesas sin tener PAYPAL ni ir a un BANCO?". wapa (in Spanish). April 11, 2024.

- ^ a b Arias Schreiber, Félix (April 29, 2024). "Yape Remesas". infobae (in Spanish).

- ^ "Rufino Arribas, líder de Yape: Los yapelovers juegan un papel importante en nuestro crecimiento". Perú21 (in Spanish). December 24, 2019.

- ^ Deakin, Arthur (November 5, 2020). "Winning in p2p in Latin America: how traditional banks can stay in the fold". AMI.

- ^ "Yape celebra por los 8 millones de usuarios alcanzados". Ecommerce News (in Spanish). November 30, 2021.

- ^ Vásquez, Ruben (July 8, 2022). "Yape llega a los 10 millones de usuarios". EcommerceNews (in Spanish).

- ^ García Briceño, Bethania (February 13, 2024). "Yape superó los 14 millones de usuarios en el 2023". EcommerceNews (in Spanish).

- ^ "Yape Peru's Super App and TerraPay join forces to accelerate digital inclusion". PR Newswire (in Spanish). October 29, 2024.

- ^ García Briceño, Bethania (October 7, 2024). "Yape alcanzó 1 millón de negocios en Bolivia". EcommerceNews (in Spanish).

- ^ Chuquijajas, David (September 4, 2024). "El Éxito de Yape: La Fintech que Revoluciona los Pagos en Perú y Bolivia". Linkedin (in Spanish).

- ^ García Briceño, Bethania (January 31, 2025). "Yape alcanzó los 20 millones de usuarios en Perú y Bolivia". EcommerceNews (in Spanish).

- ^ Chuquijajas, David (June 25, 2025). "De heladeros a 20 millones de usuarios: La historia de Yape y las lecciones de Raimundo Morales". LinkedIn (in Spanish).

- ^ Espinoza, Analí (June 3, 2025). "Yape de Perú conquista Bolivia: la app del BCP tiene más de 3 millones de usuarios y es la favorita de los bolivianos". infobae (in Spanish).

- ^ "¿Se puede cancelar un envío en Yape?: Lo que debes saber si te equivocas al transferir dinero". Radio EXITOSA (in Spanish). July 8, 2025.

- ^ "¿Qué hacer si realizas un Yape a un número equivocado?". N60.pe (in Spanish). June 7, 2025.

- ^ García Briceño, Bethania (October 31, 2024). "Por qué ya no se visualizan los nombres completos en transferencias de Yape" (in Spanish).

- ^ "Cómo saber el número de la persona que me yapea". El Tiempo (in Spanish). July 21, 2025.

- ^ "Yape cambió la visualización de los nombres al hacer una transferencia: así se muestra el nombre del destinatario en 2025". La República (in Spanish). January 19, 2025.

- ^ "Sunat fiscalizará ingresos de pequeños negocios que usen Yape y Plin a partir de los S/45.000". La República (in Spanish). July 11, 2025.

- ^ "Sunat fiscaliza el uso de Yape y Plin para los pequeños negocios: ¿qué cambios traerá para los comerciantes?". La República (in Spanish). July 9, 2025.

- ^ "¿Tienes un negocio y usas Yape o Plin? Sunat te fiscalizará si tus ingresos superan este monto". PeruRetail (in Spanish). July 5, 2025.

- ^ "Estafa en Yape: nueva modalidad de fraude digital". LoretoNoticias (in Spanish). March 7, 2025.

- ^ "Las estafas con 'Yape falso' no paran: Estas son las cuatro maneras de prevenirlas". infobae (in Spanish). June 19, 2025.

- ^ "Así funciona el 'Código De Seguridad' de Yape para evitar los falsos yapeos". El Comercio (in Spanish). April 1, 2025.

- ^ "Adiós a los falsos yapeos: ¿en qué consiste y cómo activar la nueva actualización de Yape para evitar estafas?". La Republica (in Spanish). April 2, 2025.

- ^ Acevedo, Jordy (April 1, 2025). "Yape lanza código de seguridad para evitar fraudes en transferencias". InfoMercado (in Spanish).

- ^ "Evita que te hackeen si usas Yape o Plin". ElMen (in Spanish). May 22, 2025.

- ^ "¿Te robaron el celular o lo perdiste? Sigue estos pasos para bloquear tu cuenta de Yape por seguridad". El Comercio (in Spanish). January 28, 2025.

- ^ "Este es el seguro de Yape que paga hasta 3,500 soles". El Comercio (in Spanish). July 23, 2024.

- ^ García Briceño, Bethania (September 10, 2024). "Yape lanza CeluSeguro: ¿Cuánto cuesta?". eCommerce (in Spanish).

- ^ "Piura: ¡Cuidado! Si presta su Yape podría ir a la cárcel". La Hora (in Spanish). February 26, 2025.

- ^ De la Cruz, Angie (July 15, 2025). "No prestes tu Yape a nadie: Policía Nacional advierte que puedes estar involucrado en grave delito sin saberlo". Libero (in Spanish).

- ^ "Pareja de presidiario es detenida por recibir S/500 en su cuenta de 'Yape'". NP (in Spanish). March 14, 2025.

- ^ "Trujillo: trabajador de UNT dio a extorsionador su cuenta de Yape para recibir cupo de S/. 10 mil". n60 (in Spanish). April 25, 2025.

- ^ Morelo, Jhosselyn (November 23, 2024). ""Abre tu Yape o te mato": Ladrón armado roba 1400 soles a joven en minimarket". Peru 21 (in Spanish).

- ^ "Yape sufrió caída en su sistema: usuarios reportaron que no podía acceder ni realizar transacciones". La República (in Spanish). June 29, 2024.

- ^ Morán, Fabrizio (July 30, 2024). "Yape hace importante pronunciamiento tras caída de su sistema a escala nacional". Expreso (in Spanish).

- ^ Valladolid, Sebastián (February 28, 2025). "Yape colapsa a nivel nacional y paraliza pagos: ¿Qué dijo el BCP?". infoMercado (in Spanish).

- ^ "Yape y bcp colapsaron al mediodía: usuarios quedan sin opciones". Soy Independiente (in Spanish). May 24, 2025.

- ^ García Briceño, Bethania (May 16, 2025). "BCP y Yape sufren caída de servicios, afectando a usuarios en Perú". eCommerce (in Spanish).

- ^ "Yape sufrió caída de sistema: usuarios reportaron problemas al realizar transferencias usando la billetera digital". La República (in Spanish). July 11, 2025.

- ^ "yape colapsa y deja a usuarios sin transacciones". Panamericana.pe (in Spanish). July 8, 2025.

- ^ Perez, Diego (August 24, 2023). "Peruvian fintech Yape expands to Bolivia". LatamList (in Spanish).

- ^ Bethania, García Briceño (October 7, 2024). "Yape alcanzó 1 millón de negocios en Bolivia". eCommerceNews (in Spanish).

- ^ "Tradición y tecnología en sinfonía: Yape es auspiciador oficial del Carnaval de Oruro 2025". Brujula Noticias (in Spanish). January 28, 2025.

- ^ Bethania, García Briceño (June 6, 2025). "Yape conquista Bolivia y lidera el mercado financiero digital". eCommerceNews (in Spanish).

- ^ Espinoza, Analí (Jun 3, 2025). "Yape de Perú conquista Bolivia: la app del BCP tiene más de 3 millones de usuarios y es la favorita de los bolivianos". infobae (in Spanish).

- ^ "Yape conquista Bolivia: ya es la billetera móvil más usada y supera los 3 millones de usuarios". PeruRetail (in Spanish). June 5, 2025.

- ^ "Yape se renueva: aplicativo anuncia expansión regional y nuevas funciones para el 2025". wapa (in Spanish). November 12, 2024.

- ^ Tuesta Benavides, Bruno (July 12, 2024). "Yape llegaría a otros países en Latinoamérica: ¿cuáles?". eCommerceNews (in Spanish).

- ^ Flores, Daniel (July 13, 2024). "Yape se expande hacia Centroamérica: ¿Tendrá nuevas funcionalides?". inforMercado (in Spanish).